Online reputation has become the number one factor in consumer buying EzDataMunch’s risk analytics dashboards for bank, allows managers to mitigate risk by getting accurate insight into counter party credit risk exposure, customer credit history and rating. Banks can adhere to regulatory compliance by ensuring high standards of reporting and transparency and take accurate business decisions.

Banks are highly prone to volatile markets, fluctuating customer sentiments, credit default and internal operational risks. There has been lack of transparency in accounting and reporting standards. Also, previous market crash has shaken the customer. Regulators have come up with more stringent rules for banks to ensure safety of both customers and banks. Regulatory framework such as Basel II/III, Solvency II, Dodd-Frank and more, impose compliance and reporting requirements that becomes a complex issue for banks. However banks that adhere to these norms are better recognized and appreciated. Banks are incentivised for following these guidelines. Analysts can mitigate the underlying risk and comply with the regulations. This can be achieved by collecting data from multiple line of business like loans, credit cards, insurance, mortgages and transforming it into accurate visual information.

Banks often face high risk of credit repayment defaults by customers. Decision makers try to reduce this risk by creating and analyzing a 360 degree view of customers. However, major time is spent on manipulating the data into right format leaving less time for analyzing it and transforming it into action.

- Get detailed insight into all kinds of credit products like loan, credit card, mortgages and so on in the same dashboard.

- View current balance of all products by segments to know which product entails high risk based on volumes and make necessary arrangements.

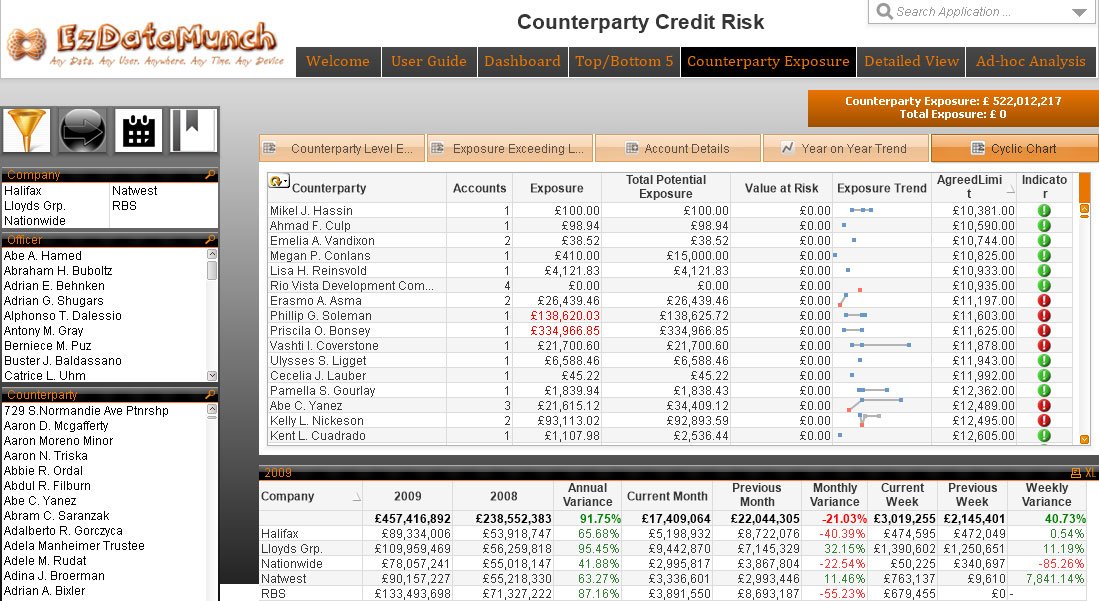

- Take prophylactic measures by analyzing and comparing counter party exposure limit by agreed upon limit.

- Check risk level based on colored indicators that represents customer portfolio risk as per pre-defined market standards.

- Compare trends across product segments and define top and bottom customers to gauge default possibility.

- Compare counter party credit risk variance as per week, month and year to see the changes in the capital involved and avoid unnecessary defaults.

- Analyze every counter party in details by knowing their exposure limit, whether the limit has been crossed or not.

- Know the value at risk if the limit is crossed and track trends in exposure.

- See indicators to know the risk quotient entailed by each counterparty to take appropriate actions.

Let’s Get Started

Drive business success by analyzing, exploring, and effortlessly sharing insights with EzDataMunch!

Take your business to new heights with EzDataMunch. Dive into data, explore insights, and share them easily. EzDataMunch makes it easy to grow your business. You don’t have to worry about complicated analysis. Just concentrate on moving your business forward, and EzDataMunch will handle the rest.