Insurance Analytics

Provide right product to right customer, analyze customer history to track suspicious claims and give the best price at the right time to increase profit.

Home / Insurance

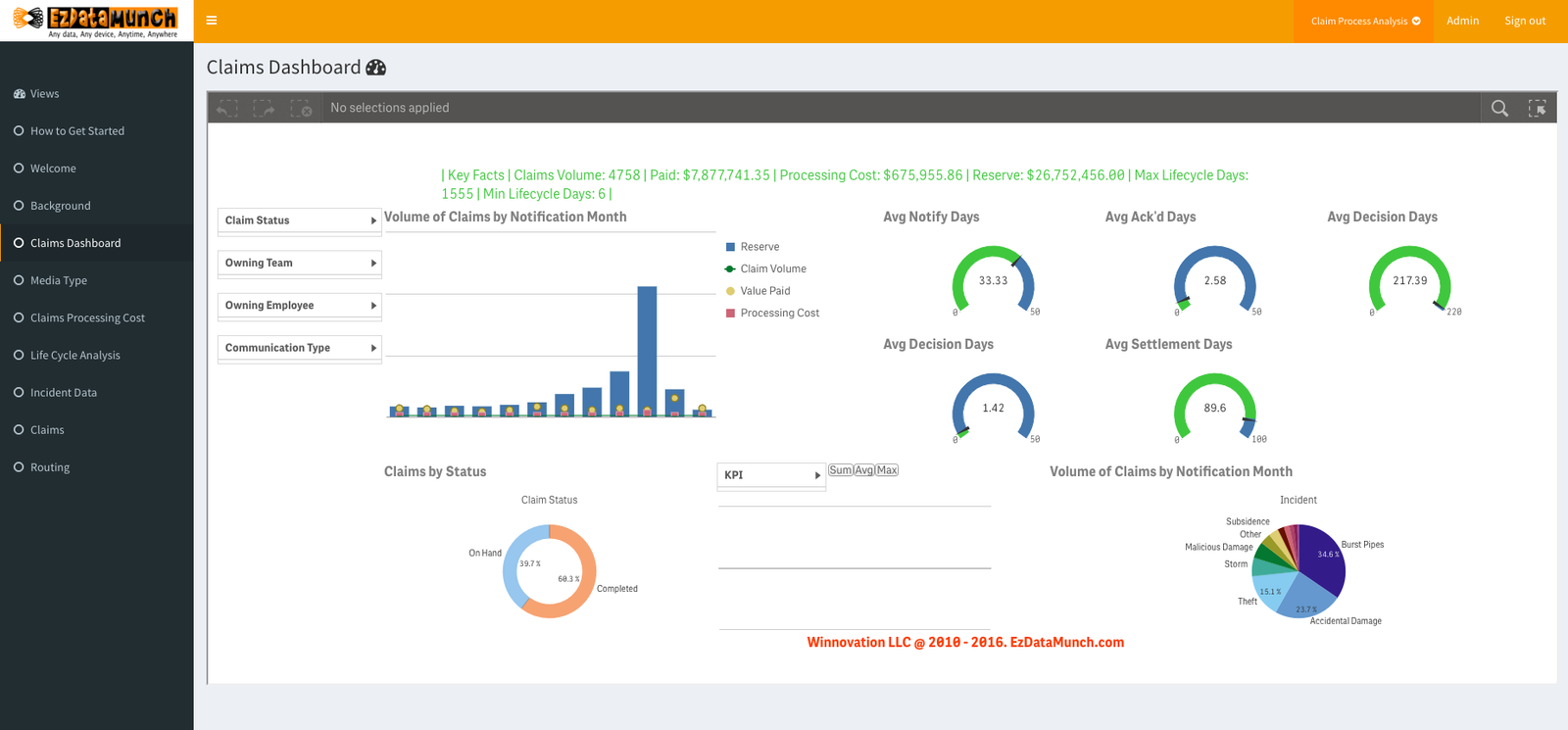

EzDataMunch’s suite of pre-built insurance analytics dashboards gives companies real-time visibility in all of their business processes. Our easy to use and highly scalable solutions transform complex data into graphical charts in minutes. This information is available to managers anywhere and anytime and helps them take data driven decisions.

Insurance Analytics

With EzDataMunch Insurance Analytics Dashboard, you can make sure you’re following the rules, offering competitive prices, and making more money. Our solutions help insurance companies stay compliant with regulations, set prices that are competitive with other companies, and increase their profits.

Increased competition and stringent regulations have created pressure on insurance companies to improve their products and enhance their operations. Customers are demanding more transparency in terms of product information and documentation and lesser time for claim disbursement. Insurance companies are facing fraudulent claims which are increasing at an alarming rate. This scenario has pushed companies to have a comprehensive insurance data analytics solution that can help them in proper pricing of their product, manage assets and reduce risk. Insurance companies are rife with data.

- This data is being generated from disparate systems such as claims management and call centers.

- Customer’s data through marketing channels and customer behavior.

- Insurance application forms and data from brokers or agents.

- The challenge here is how to empower leaders at various levels to use this data and make informed decisions.

Claims

Reduce claims processing time, avoid frauds & eusure custome satisfaction.

Risk

Identify account & product risk, evade fraud & adhere to business rules.

Premium & Loss

Understand premium & loss per product, customize products, forecast profits